The One Big Beautiful Bill Act: The Good, The Bad, and The Ugly

By Alex Cobb, JD, LL.M, Caleb Knepper, JD, LL.M and David Gaitanis, CPA

On July 4, 2025, the One Big Beautiful Bill Act (OBBB) was signed into law. This landmark legislation preserved a large part of the 2017 Tax Cuts and Jobs Act (TCJA) and introduced new provisions that may significantly shape charitable giving and other tax planning strategies. This article summarizes the new rules that affect charitable giving and other key provisions that may be relevant for advisors, clients, and donors as they consider their tax planning.

New Charitable Giving Provisions Introduced by OBBB

The Good (for taxpayers giving to charities)

Permanent increase in AGI limitation for gifts of cash to public charities: The OBBB makes permanent the 60% of Adjusted Gross Income (AGI) limitation (increased from 50%) for cash gifts made to public charities that was initially set to expire after 2025.

Above-the-line deduction for non-itemizers: A new $1,000 above-the-line deduction for cash donations to public charities (but not donor advised funds) for taxpayers who take the standard deduction ($2,000 for joint filers).

Example: Sam and Diane are married and file their taxes jointly using the standard deduction. They have $200,000 in income, collectively. Sam donated $500 to UF to support athletics and Diane donated $1,500 to UF to support the College of Education. Sam and Diane will be able to claim a deduction of $2,000 for their charitable contributions to UF on top of the standard deduction.

The Bad (for taxpayers giving to charities)

New floor on charitable deductions: The OBBB introduces a reduction in the charitable deduction by 0.5% of a taxpayer’s tax base, effectively reducing the charitable deduction by 0.5% of their AGI.

Example: Julie has a $500,000 tax base, and 0.5% of that is $2,500. If Julie makes a charitable contribution of $10,000 to UF to support the Harn Museum of Art, she can only deduct $7,500 ($10,000 – $2,500) on her taxes for that year. This reduction is in addition to the 2/37ths adjustment, if applicable (see below).

The Ugly (for taxpayers giving to charities)

New limits to deductions for itemizers in the 37% bracket: Effective in 2026 and moving forward, for taxpayers in the 37% income tax bracket (for 2026 – over $640,600 for single filers and $768,700 for married couples filing jointly), the deductible amount must be reduced by 2/37 of the lesser of: (1) the total amount of itemized deductions, or (2) the amount by which the taxable income exceeds the income threshold for the 37% tax bracket. This applies to all itemized deductions, including charitable deductions.

Example: Jim is single and has $800,000 in income and total itemized deductions of $500,000. Assuming the 37% threshold is $700,000 (for simplicity), then $100,000 is subject to the 2/37ths rule since $100,000 (amount of income above the 37% threshold) is lower than $500,000 (total amount of itemized deductions). Jim will have $5,405 ($100,000 x 2/37) disallowed as a deduction, resulting in a tax effect of $2,000 in additional tax.

Example at higher income level: Bill and Mary file jointly and have $1.7M in income and total itemized deductions of $1.2M. Assuming the 37% threshold is $700,000 (for simplicity), then $1M is subject to the 2/37ths rule since $1M (amount of income above the 37% threshold) is lower than $1.2M (total amount of itemized deductions). Bill and Mary will have $54,100 ($1M x 2/37) disallowed as a deduction, resulting in a tax effect of $20,000 in additional tax.

Other Individual Tax Provisions

Senior Deduction: A temporary $6,000 deduction for seniors age 65 and older per qualifying taxpayer is added for the years 2025 – 2028 and phases out for taxpayers with modified AGI over $75,000 for single taxpayers ($150,000 for joint filers).

Child Tax Credit: The credit is permanently increased to $2,200 in 2026, with annual inflation adjustments.

Mortgage and SALT Deductions: The mortgage interest cap on $750,000 of principal is retained, and the State and Local Tax (SALT) deduction cap is temporarily raised to $40,000, phasing down after 2029 to $10,000. This increased deduction is subject to aggressive phaseouts for AGI exceeding $500,000.

Preservation of Higher AMT Exemption Amount: The OBBB preserves the higher exemption amount for the Alternative Minimum Tax (AMT) and phaseout thresholds of the TCJA with some inflation adjustment changes. In 2026, the phaseout thresholds will be reset to the 2018 values of $500,000 for single filers and $1M for joint filers and adjusted for inflation moving forward.

Example Incorporating Multiple New Provisions

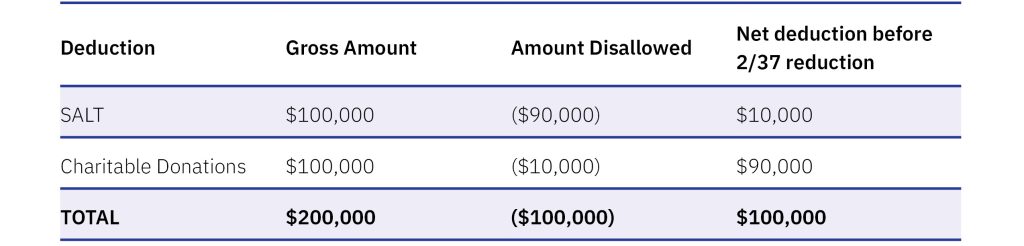

Ed and Nancy are a married couple with Modified Adjusted Gross Income (MAGI) of $2M and the following deductions in 2026 (assume the top tax bracket starts at $700,000 for simplicity):

First, $90,000 in SALT deduction will be disallowed since this couple’s income exceeds the $500,000 threshold by $1.5M (while the 2/37ths rule applies to MAGI, the SALT deduction limitation applies to AGI – for the purposes of this example, we will assume they are the same for simplicity). Applying the 30% phaseout for each dollar earned above $500,000, this results in a $450,000 reduction in their allowable deduction. Since this exceeds the $40,000 cap, the deduction would phase down to the guaranteed amount of $10,000.

Second, the new 0.5% floor will reduce the couple’s charitable deduction by $10,000 ($2M x 0.005 = $10,000).

With the total amount of their allowable deductions reduced by $100,000, this couple now has a net deduction of $100,000 before applying the 2/37ths rule.

Since this couple has $1.3M of income in the 37% rate, and their net itemized deductions are $100,000, 2/37 of $100,000 (the lower of the two numbers) will be disallowed. This means that $5,405 of their $100,000 in itemized deductions are disallowed, increasing their tax by $2,000.

Business Tax Provisions

Bonus Depreciation: The OBBB restores and makes permanent 100% bonus depreciation for short-lived asset investments.

Pass-through Business Deduction: The OBBB extends and makes permanent the Section 199A pass-through deduction, which allows pass-through business owners to deduct 20% of qualified business income when calculating taxable income.

Charitable Giving by Corporations: Charitable giving by corporations may not exceed 10% of corporate taxable income. Additionally, charitable deductions for corporations will only be allowed if they exceed 1% of the corporation’s taxable income for tax years beginning after December 31, 2025.

Income Tax Strategies for Charitable Giving

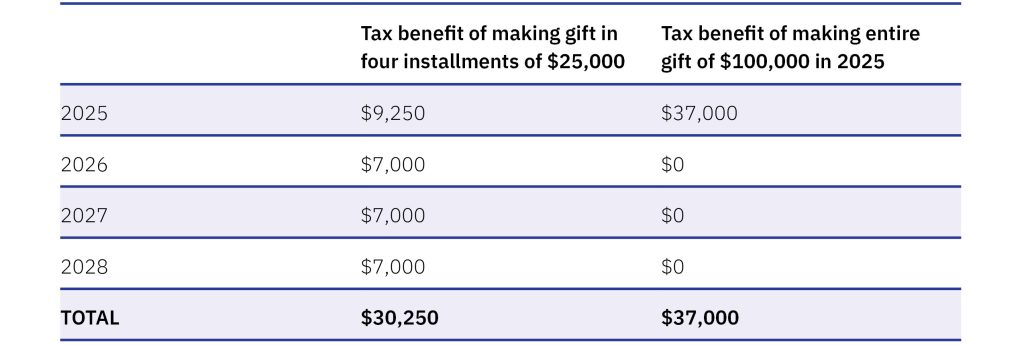

Taxpayers should consider “bunching” strategies to consolidate multiple years of giving into 2025 to maximize the tax benefits.

Example: Albert is a single taxpayer with $1M in income annually and plans to make a gift of $100,000 to support the Levin College of Law. Albert is unsure of whether he should “bunch” his gifts by accelerating his entire gift amount into 2025 or if he should pay this gift in four annual installments of $25,000, beginning in 2025. The tax benefit comparison is below:

With the 2/37ths rule reducing itemized deductions for high‑income taxpayers by about 5.4%, some are weighing whether to accelerate pledge payments. The net economic loss from decreased tax savings for these taxpayers is approximately 2%. 2% is calculated as 2/37 of the 37% top income tax bracket. Also, the 0.5% floor results in an additional net economic loss equal to about 0.185% from disallowed tax savings. To reach 0.185%, the 0.5% floor is multiplied by the 37% top bracket which equals 0.185% in value lost. Options to address this include advancing pledge schedules through bunching, or where eligible, using QCDs. Advisors may also consider other planning and investment strategies beyond tax planning to help mitigate the impact of these changes.

As of October 2025, insured CDs are paying 4.35% – 4.45% APY. For some donors, keeping funds earmarked for charitable contributions in a CD or other conservative investment may generate more value than advancing pledge payments solely to avoid the 2/37th limitation or 0.5% floor beginning in 2026, while still preserving flexibility to meet philanthropic commitments. Advisors may find bunching strategies most effective for gifts planned in 2026, while future‑year donations can remain invested in vehicles like CDs to provide greater long‑term value.

Taxpayers who are 70½ and older should consider using Qualified Charitable Distributions (QCDs) to make charitable gifts. Using QCDs will count toward a taxpayer’s required minimum distribution (RMD) while also avoiding the new 0.5% floor and the 2/37ths rule.

Estate Tax Provisions

The OBBB permanently raises the estate and gift tax exemption to $15 million for individuals ($30 million for married couples), indexed for inflation. Therefore, for many people, estate tax planning is no longer a concern and income tax planning for their heirs has become increasingly important. This is especially true as it relates to income with respect to a decedent (IRD) assets such as retirement accounts.

The SECURE Act of 2019 forced most designated beneficiaries to use a ten-year period over which to withdraw all assets from an inherited retirement account instead of stretching the payments over their life expectancy.

One method of recreating the “stretch” payments is to leave the retirement account to a testamentary charitable remainder unitrust (TCRUT) that will pay the beneficiary a percentage of the assets each year until the beneficiary passes away. This will allow a longer period of time for the assets to grow tax free within the CRUT, while also stretching out the payments from the account. This spreads out the tax burden and possibly allows the beneficiary to stay in lower tax brackets than they would have had they been forced to withdraw all of the assets from the plan over only ten years.

Conclusion

The information above outlines key updates in tax changes from the OBBB. While the OBBB has permanently raised estate and gift tax exemptions, income tax planning for heirs is now more important for most people. Innovative approaches like testamentary charitable remainder unitrusts can help beneficiaries manage withdrawals and taxes over time. Encourage your clients to begin planning now around what changes, if any, they should make to their charitable strategies and the timing of their gifts. As with any financial or tax matter, it is important to help clients evaluate how these changes specifically affect their circumstances and integrate charitable planning into their broader wealth and tax strategies.